How Much Taxes Did a Medieval Peasant Pay? The numbers from Sweden. medievalists.net

Medieval taxes can be categorised into lay and clerical subsidies. A Poll tax is levied on heads or polls of individuals. Taxes have always been unpopular and tax avoidance was common then as it is now. They were usually demanded by the then monarch to raise money for war.

These records provide lists of tax paying individuals living in a local communities, this information is relatively rare at this time. Consequently providing valuable information for local and family historians.

The Poll Tax of 25 th year of the reign of Edward 1 st 1297

Following an attempt to tax his people without the assent of parliament, Edward I faced opposition to his plans to lead a military expedition to France. He used a letter which takes the form of a public address, Edward I attempts to justify the necessity of this taxation.

The information below represents both Fishlake and Sykehouse inhabits as the two villages were at this time one district.

The Poll Tax of 1279. (Note, these names appear at a time before last names or surnames had become universal. I have modernised the Latin names).

John son of Reginald.

Richard son of Reginald.

Robert of Croft.

John son of Sille.

Hugo son of Jordan.

Henry Miles.

Gervas Seman.

William of Prestecroft.

William Alsy

William Alsy.

Robert Muriel.

Alexander son of Reginald.

William Albus.

Peter son of Isabella.

William Godard.

Adam of Sik.

Taken from and with thanks to the YAS Record Series Vol. 016: Yorkshire lay subsidy, being a ninth collected in 25 Edward I, 1297, ed William Brown, 1894.

Nonarum Inquisitiones in Curia Saccarii Temp. Regis Edwardii III (1327-1377).

The Nonarum Inquisitiones relate to a grant by Parliament to Edward III in 1342, to assist him in his wars, of one-ninth of the value of corn, wool and lambs produced in the realm. The value of these items was assessed, parish by parish, from the evidence given by groups of parishioners under oath. These inquiries were conducted in the early months of 1342 but related to agricultural production during 1341.

Fishlake Participants.

Hugh del Croft.

John del Syk.

Richard Brown.

Peter Aylsy.

Adam son of Alexi of Balne.

William Fayrbarn.

John son of Thomas.

William Mallesom.

Peter son of Roger.

Adam of Forestecroft.

Adam del Fall.

John Poitus.

Robert de More.

Tax XL li.

The above list was obtained from a transcript left in the archives of the late vicar of Fishlake, Canon George Ornsby. With thanks to him.

The 1379 Poll Tax. In 1377 the crown Richard 11 (1377-1399) decided upon a new method of taxation a poll tax was levied on everyone over the age of 14. Then again in 1379 and 1381. By this time the populace became very unhappy with this practice leading to the Peasants’ Revolt. Note that by now last names or surnames has become fully established.

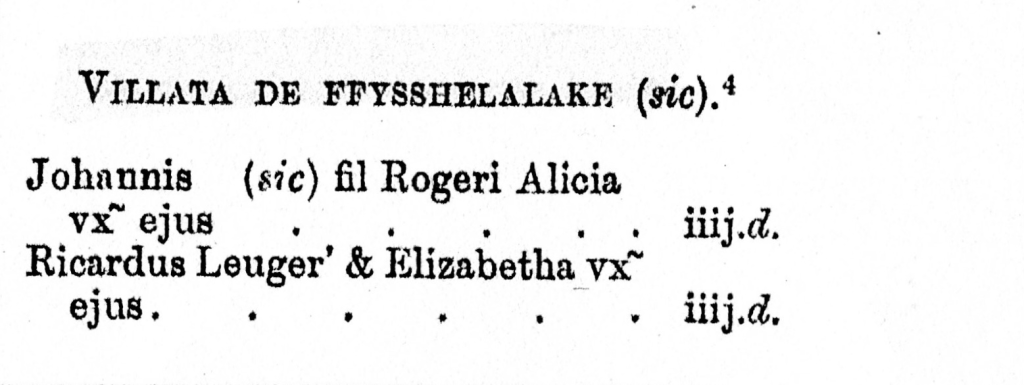

Yorkshire Subsidy Rolls for 1379. Taken with thnaks from The Yorkshire Archaeological and Topographical Journal 1879.

A summary of the above is as follows. Fishlake had a population of 154 above statutory age. Of these we find one Draper, one Spicer and one Souter paying 12d each. Also listed are other Souters two Mercer’s, two, Taylors one Smith, one Walker and one Webster each paying 6d. The rest (men and their wives counted as one) 4 d. Total xxxjs.

Robert Downing March 2023.